30+ How much will mortgage lend me

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Ifthe deposit is 40000 for the.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Type of home loans to consider The loan type you select affects your monthly mortgage payment.

. As part of an. Trusted VA Loan Lender of 300000 Veterans Nationwide. Get Your VA Loan.

However some lenders allow the borrower to exceed 30 and some even allow 40. Interest rates are expressed as an annual percentage. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

So the more you borrow and the higher the LVR the higher the risk the higher the cost of the LMI. The debt-to-income ratio which is also called the Back-End Ratio figures what. For example a 30-year fixed mortgage would have 360 payments.

Apply Online Get Pre-Approved Today. Take Advantage Of 2021 Mortgage Rates When You Buy Your Next Home. A 30-year term is 360 payments 30 years x 12 months 360 payments.

Medium Credit the lesser of. If someone has a deposit of 100000 to buy a 200000 home then the loan to value LTV rate is 50. Fill in the entry fields.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Want to know exactly how much you can safely borrow from your mortgage lender. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house loan for the purpose of purchasing.

With a 30-year fixed-rate loan your monthly payment is 125808. Are assessing your financial stability ahead of. VA Loan Expertise Personal Service.

For instance if you take on a mortgage loan that results in a total debt-to-income ratio of only 30 youre probably in good shape. The first step in buying a house is determining your budget. Fast VA Loan Preapproval.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Contact a Loan Specialist. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

The two main factors that are typically considered in determining how much mortgage you qualify for are your monthly income and your monthly expenses. The length by which you agree to pay back the home loan. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of.

Ad Compare More Than Just Rates. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Ad Compare More Than Just Rates.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Calculate what you can afford and more.

Find A Lender That Offers Great Service. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive. Find A Lender That Offers Great Service.

Compare Best Mortgage Lenders 2022. But ultimately its down to the individual lender to decide. Take Advantage Of 2021 Mortgage Rates When You Buy Your Next Home.

The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. But if youre trying take on a loan that would push your. This mortgage calculator will show how much you can afford.

But it also means the crucial loan-to-value rate is lower. Find out how much you could borrow. The Maximum Mortgage Calculator is most useful if you.

The actual cost of LMI can be difficult to estimate because it is a risk-based charge. This is what the lender charges you to lend you the money. For this reason our calculator uses your.

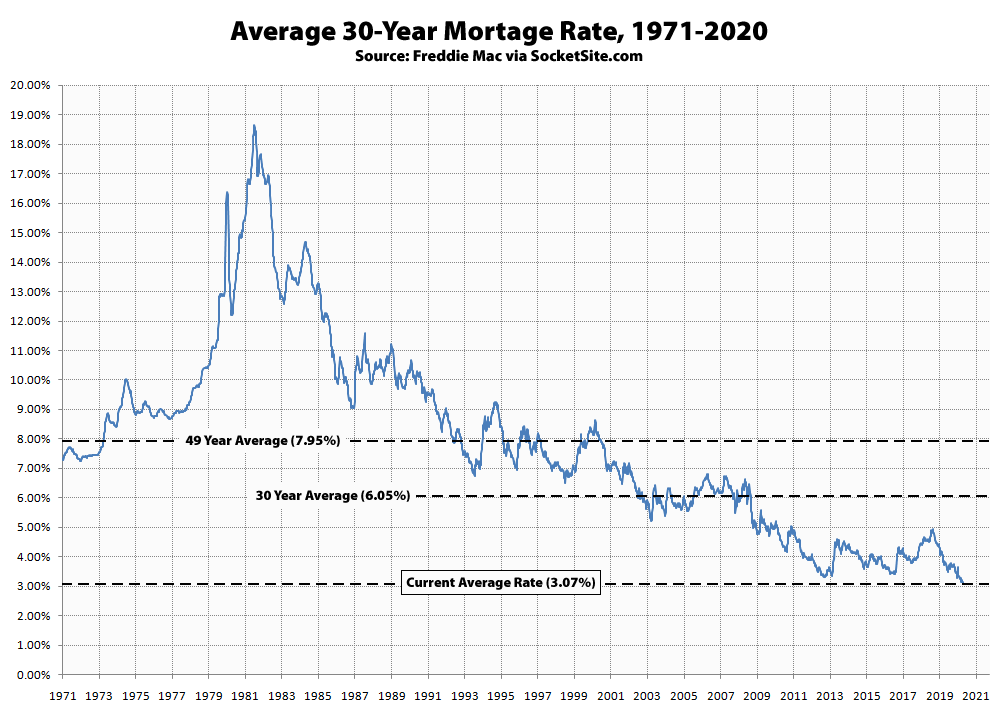

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

Loan Officer Marketing Plan Template Awesome Loan Ficer Business Plan Template Sample Marketing Plan Template Marketing Plan How To Plan

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Benchmark Mortgage Rate Nearing An Unprecedented Mark

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage

Line Of Credit Mobile Dashboard Line Of Credit Lending App Banking App

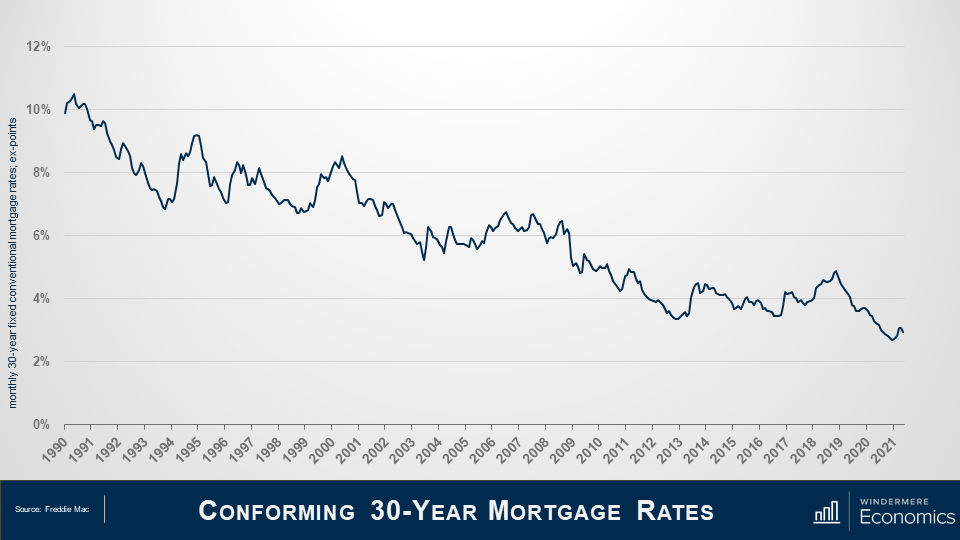

6 28 21 Housing And Economic Update From Matthew Gardner Windermere Real Estate

This 26 Week Money Saving Challenge Is The Best I M So Glad I Found This Amazing Challenge To Help Inspire And Motivate Me To Save Money This Year I Ll Be Abl

30 Flowchart Examples With Guide Tips And Templates Good Boss Management Skills Leadership Leadership Skills

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street